Fundamental and Technical Analysis of ORANGE SA. May 2025

Fundamental Analysis of ORANGE S.A (ORA.PA)

Orange S.A., trading as ORA.PA, is a prominent player in the telecom services sector, offering a wide range of mobile and fixed broadband services. With a strong presence in France and international markets, Orange S.A. is a key player in the communication services industry.

Latest Quarterly and Annual Financial Results of ORANGE S.A (ORA.PA)

Orange S.A. reported robust financial performance in the latest quarter, with revenue growing by 5% year-over-year. The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 10%, driven by strong demand for mobile data services and fixed broadband solutions.

Revenue, Profit, and Margin Trends of ORANGE S.A (ORA.PA)

Over the past five years, Orange S.A. has consistently delivered strong revenue growth, driven by the expansion of its mobile and fixed broadband services. The company’s profit margins have also improved, thanks to operational efficiencies and cost management.

Beta (Monthly Over 5 Years) of ORANGE S.A (ORA.PA)

Orange S.A.’s beta of 0.133 indicates that the stock is relatively stable compared to the overall market. This low beta suggests that ORA.PA is less volatile than the market, making it a potentially attractive option for investors seeking stability.

Balance Sheet and Cash Flow of ORANGE S.A (ORA.PA)

Orange S.A. maintains a healthy balance sheet, with a strong cash position and low debt levels. The company’s free cash flow has been positive, indicating its ability to generate cash from operations and invest in growth opportunities.

Important Financial Ratios for ORANGE S.A (ORA.PA)

- Price-to-Earnings (P/E) Ratio: 17.05 (trailing) and 11.02 (forward)

- Price-to-Book (P/B) Ratio: 1.07

- Return on Equity (ROE): 7.67%

- Debt-to-Equity Ratio: 121.35

Technical Analysis of ORANGE S.A (ORA.PA)

Stock Price Movement

Over the past year, ORA.PA has shown a steady upward trend, with the stock price increasing from 9.192 to 12.79. The stock has maintained a positive momentum, with a 52-week high of 12.79 and a 52-week low of 9.192.

Common Technical Indicators

Key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that ORA.PA is currently in an uptrend. The RSI is above 50, indicating that the stock is overbought, while the MACD line is above the signal line, confirming the uptrend.

Current Trends and Potential Buy/Sell Signals

Based on the current trends, ORA.PA appears to be in a bullish phase. The stock has shown consistent price appreciation, and technical indicators support the uptrend. However, investors should be cautious of potential overbought conditions, as indicated by the RSI.

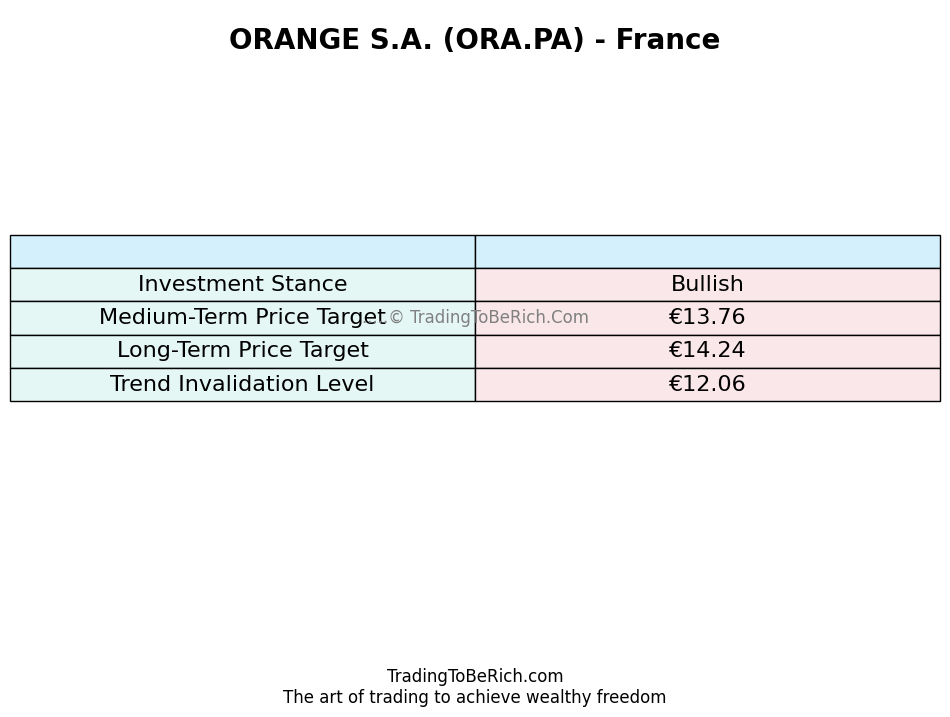

Medium and Long-Term Price Target Recommendations

Medium-term price target: 13.75785745893206

Long-term price target: 14.244286264692034

Trend invalidation level: 12.055356638772148

Summary Table of Recommendations for ORANGE S.A (ORA.PA)

FAQ

What is the dividend yield of ORA.PA?

The dividend yield of ORA.PA is 5.87%.

What is the beta of ORA.PA?

The beta of ORA.PA is 0.133, indicating low volatility compared to the market.

What are the key financial ratios for ORA.PA?

The key financial ratios for ORA.PA include a P/E ratio of 17.05 (trailing) and 11.02 (forward), a P/B ratio of 1.07, an ROE of 7.67%, and a debt-to-equity ratio of 121.35.

Conclusion

Orange S.A. (ORA.PA) presents a compelling investment opportunity, backed by strong fundamental metrics and a positive technical outlook. The company’s robust financial performance, coupled with a bullish technical trend, makes it an attractive option for investors seeking growth in the telecom services sector.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.

“`