Trade Journal & KPI Template : Log your trades, track your psychology

How to use this template

Daily

- Pre-trade ritual (1–2 minutes): rules, size, breathing.

- Log each trade the moment you place it.

- Note emotions; mark rule breaks explicitly.

Weekly

- Compute KPIs (win rate, expectancy, drawdown).

- Review rule-break rate; adjust friction points.

- Iterate: one tiny change at a time.

Monthly

- Assess regime fit (trend/volatility/liquidity).

- Re-scale risk if needed (up/down by 10–20%).

- Archive learnings; reset focus.

Trade Journal (scroll horizontally on mobile)

Keep entries short, factual, and consistent. All monetary metrics in R (risk units) to standardize across instruments.

| Date | Market | Timeframe | Setup | Entry | Stop | Exit | Risk (R) | Result (R) | Emotion/Notes | Rule Break? |

|---|---|---|---|---|---|---|---|---|---|---|

| YYYY-MM-DD | EUR/USD | H1 | RSI pullback + structure | 1.0850 | 1.0825 | 1.0890 | 0.50 | +1.00 | Calm; followed plan. | No |

| YYYY-MM-DD | NASDAQ | M15 | Range fade | 17600 | 17680 | 17490 | 0.40 | -0.40 | Exited early; nervous. | Yes — early exit |

Tip: keep “R” fixed per trade (e.g., 0.5R or 1.0R). It stabilizes emotions and simplifies stats.

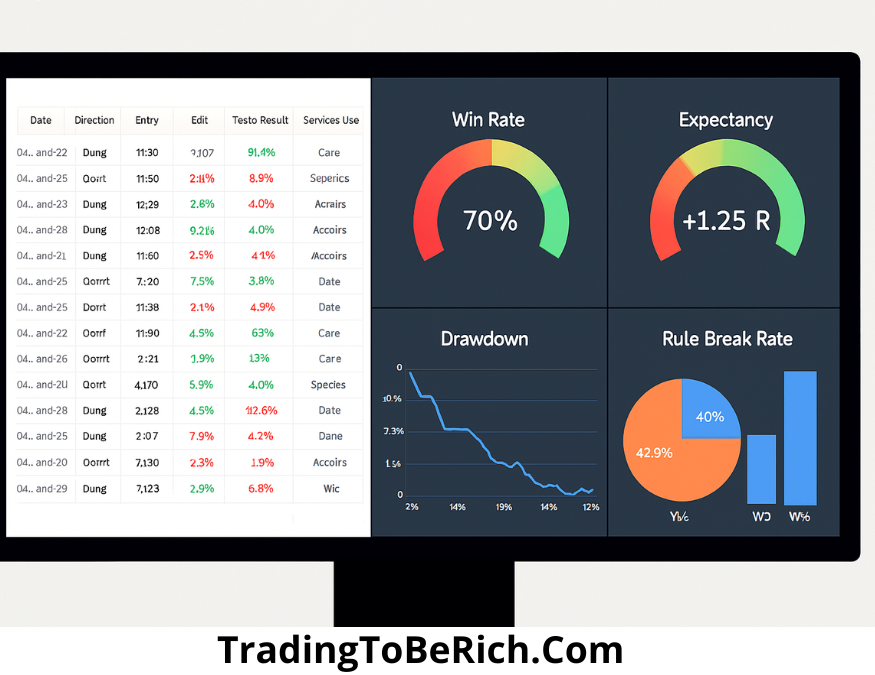

KPI Dashboard (formulas & targets)

Compute weekly. Keep it simple: fewer KPIs, better decisions.

| KPI | Formula (R-based) | Healthy Range | Notes |

|---|---|---|---|

| Win Rate | Wins / (Wins + Losses) | 40–60% (strategy dependent) | Lower win rate can work with bigger avg winners. |

| Expectancy | (Win% × AvgWin) − (Loss% × AvgLoss) | ≥ +0.20 R/trade | Your north star for compounding. |

| Avg Winner / Avg Loser | SumWins/WinCount ÷ |SumLosses/LossCount| | ≥ 1.3x (trend) • ≥ 1.0x (mean-revert) | Equal sizing and honest stops are key. |

| Max Drawdown | Max peak-to-trough loss (in R) | Keep < 8–12 R (weekly) | Trigger a cool-off or size cut. |

| Rule-Break Rate | Rule-break trades / total trades | < 10% | If higher, fix behavior before tactics. |

Expectancy example: Win% 45%, AvgWin 1.4R, Loss% 55%, AvgLoss 0.8R → 0.45×1.4 − 0.55×0.8 = +0.19R (nearly there).

Weekly Review Checklist

Process

- Did I follow pre-trade ritual?

- Any forced trades? Why?

- Were stops and size consistent?

Performance

- Expectancy trend: up / flat / down?

- Rule-break rate improving?

- Any regime mismatch?

Next Steps

- One tiny rule to adjust.

- One friction to remove (e.g., alerts).

- Risk scale: hold / up 10% / down 10%.

Emotion Log (identify triggers)

Short labels beat long essays. Name it → tame it.

| Moment | Emotion | Trigger | Action |

|---|---|---|---|

| Pre-trade | Anxious | Large gap at open | Half size; confirm structure. |

| During trade | Excited | Quick profit | Trail stop; avoid adding risk. |

| Post-loss | Frustrated | Second loss in a row | Mandatory break; review rules. |

Risk Rules (paste into your desk)

- Fixed risk per trade: 0.5–1.0R.

- Daily loss cap: -2R to -3R then stop.

- Time cutoff (e.g., 2 hours / session).

- No averaging down. Ever.

- Size down in unclear regimes.

- Only trade your written setup(s).

- Journal instantly; tag rule breaks.

- Weekly KPI review, tiny iteration.

- Reduce risk after new equity lows.

- Rest day after emotional spikes.

Mini Dashboard (fill & review)

| Week | Trades | Win % | Expectancy (R) | Max DD (R) | Rule-Break % |

|---|---|---|---|---|---|

| W-01 | 12 | 50% | +0.22 | -2.0 | 8% |

| W-02 | 10 | 40% | +0.15 | -2.5 | 5% |

Notes & Learnings

• What worked this week?

• What failed (process vs. strategy)?

• One tiny change for next week:

Kostolany to Algorithms

Market Psychology

Market Psychology