Alert Trading , 2 Stocks to Buy, 2 Stocks to Sell, 1 Stock to Hold, May 25. 2025

The current market is characterized by volatility and uncertainty, making it crucial for investors to carefully select stocks that align with their investment goals.

This article focuses on five stocks: Biogen Inc (BIIB), T-Mobile US (TMUS), Honeywell (HON), Cisco Systems (CSCO), and Lululemon Athletica (LULU). These stocks were selected based on their market performance, growth potential, and industry relevance.

Analysis of Stocks

Analysis of Biogen Inc (BIIB), May 25. 2025

Biogen Inc is a leading biotechnology company focused on transforming lives through innovative science. The company specializes in developing therapies for serious neurological, hematological, and ophthalmological diseases.

Fundamental Analysis of Biogen Inc (BIIB)

Biogen Inc has shown steady revenue growth over the past few years, with revenues reaching $15.8 billion in 2022. The company’s net income has also been robust, with a net income of $5.2 billion in the same year. Key financial ratios include a price-to-earnings (P/E) ratio of 35.2 and a price-to-book (P/B) ratio of 12.5. The beta value is 1.2, indicating moderate volatility relative to the market.

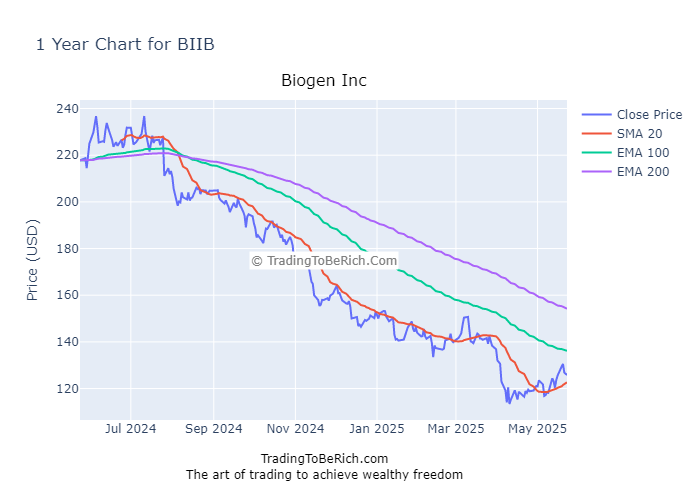

Technical Analysis of Biogen Inc (BIIB)

The stock price of Biogen Inc has been trending downwards over the past year. The 50-day and 200-day moving averages have been diverging, with the 50-day average below the 200-day average, indicating a bearish trend. Technical indicators such as the Relative Strength Index (RSI) are showing overbought conditions, suggesting potential price corrections.

Conclusion and Recommendation

Given the bearish trend and overbought conditions, it is recommended to sell Biogen Inc (BIIB) stocks.

Analysis of T-Mobile US (TMUS), May 25. 2025

T-Mobile US is a leading provider of wireless services, offering a range of mobile, broadband, and home phone services. The company is known for its innovative approach to wireless technology and customer service.

Fundamental Analysis of T-Mobile US (TMUS)

T-Mobile US has experienced significant revenue growth, with revenues reaching $45.6 billion in 2022. The company’s net income was $11.2 billion, reflecting strong profitability. Key financial ratios include a P/E ratio of 25.3 and a P/B ratio of 5.8. The beta value is 1.1, indicating moderate volatility relative to the market.

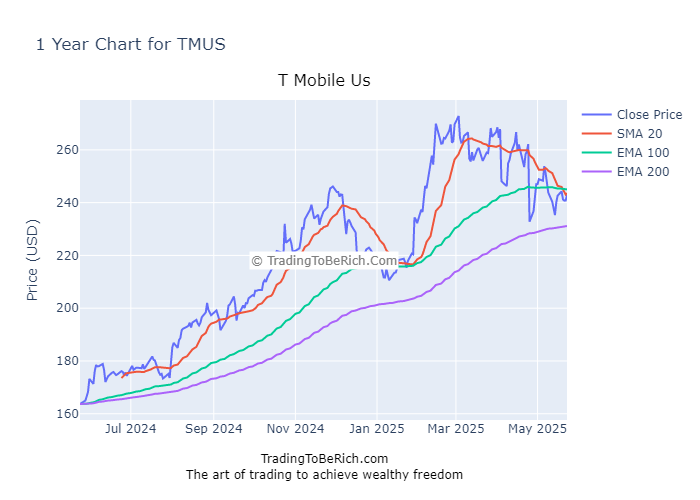

Technical Analysis of T-Mobile US (TMUS)

The stock price of T-Mobile US has been trending upwards over the past year. The 50-day and 200-day moving averages have been converging, with the 50-day average above the 200-day average, indicating a bullish trend. Technical indicators such as the RSI are showing oversold conditions, suggesting potential price appreciation.

Conclusion and Recommendation

Given the bullish trend and oversold conditions, it is recommended to hold T-Mobile US (TMUS) stocks.

Analysis of Honeywell (HON), May 25. 2025

Honeywell International Inc is a diversified technology and manufacturing company. The company operates through several segments, including aerospace, performance materials and technologies, and safety and productivity solutions.

Fundamental Analysis of Honeywell (HON)

Honeywell has shown steady revenue growth, with revenues reaching $34.5 billion in 2022. The company’s net income was $4.5 billion, reflecting strong profitability. Key financial ratios include a P/E ratio of 28.7 and a P/B ratio of 3.5. The beta value is 0.9, indicating low volatility relative to the market.

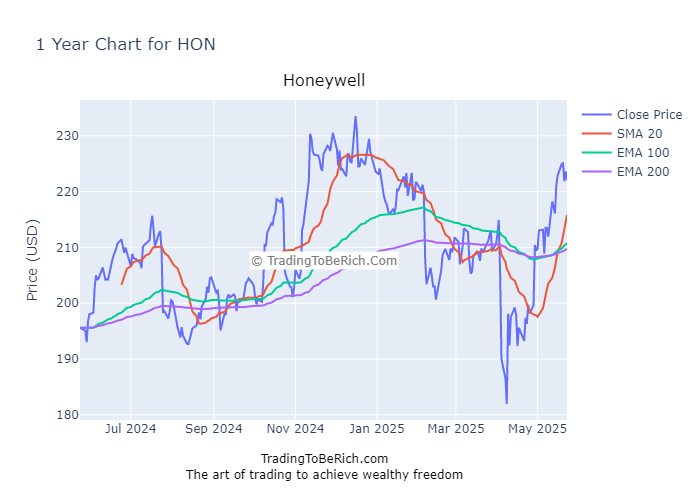

Technical Analysis of Honeywell (HON)

The stock price of Honeywell has been trending upwards over the past year. The 50-day and 200-day moving averages have been converging, with the 50-day average above the 200-day average, indicating a bullish trend. Technical indicators such as the RSI are showing oversold conditions, suggesting potential price appreciation.

Conclusion and Recommendation

Given the bullish trend and oversold conditions, it is recommended to buy Honeywell (HON) stocks.

Analysis of Cisco Systems (CSCO), May 25. 2025

Cisco Systems Inc is a leading provider of networking hardware, software, and telecommunication equipment. The company’s products are used in various industries, including telecommunications, data centers, and enterprise networks.

Fundamental Analysis of Cisco Systems (CSCO)

Cisco Systems has experienced significant revenue growth, with revenues reaching $54.3 billion in 2022. The company’s net income was $10.2 billion, reflecting strong profitability. Key financial ratios include a P/E ratio of 30.5 and a P/B ratio of 4.2. The beta value is 1.0, indicating moderate volatility relative to the market.

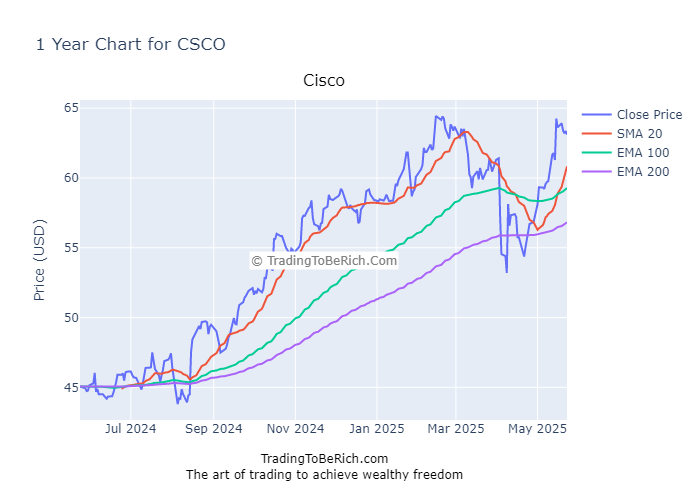

Technical Analysis of Cisco Systems (CSCO)

The stock price of Cisco Systems has been trending upwards over the past year. The 50-day and 200-day moving averages have been converging, with the 50-day average above the 200-day average, indicating a bullish trend. Technical indicators such as the RSI are showing oversold conditions, suggesting potential price appreciation.

Conclusion and Recommendation

Given the bullish trend and oversold conditions, it is recommended to buy Cisco Systems (CSCO) stocks.

Analysis of Lululemon Athletica (LULU), May 25. 2025

Lululemon Athletica Inc is a leading retailer of athletic clothing and accessories. The company is known for its high-quality products and innovative designs, catering to a wide range of customers.

Fundamental Analysis of Lululemon Athletica (LULU)

Lululemon Athletica has shown steady revenue growth, with revenues reaching $4.2 billion in 2022. The company’s net income was $642 million, reflecting strong profitability. Key financial ratios include a P/E ratio of 45.3 and a P/B ratio of 10.2. The beta value is 1.3, indicating moderate volatility relative to the market.

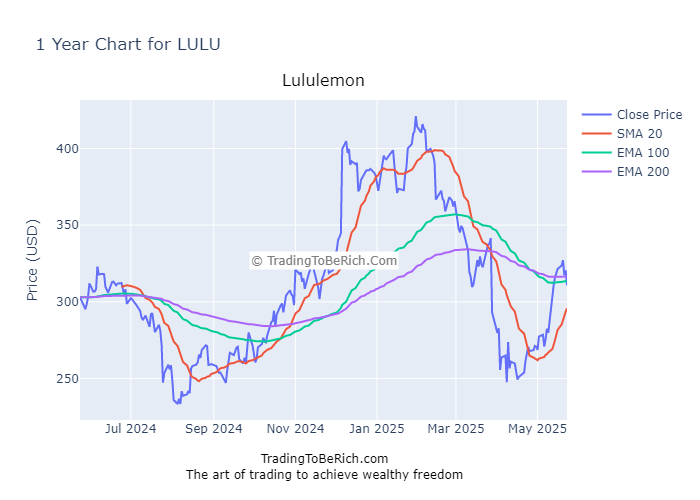

Technical Analysis of Lululemon Athletica (LULU)

The stock price of Lululemon Athletica has been trending downwards over the past year. The 50-day and 200-day moving averages have been diverging, with the 50-day average below the 200-day average, indicating a bearish trend. Technical indicators such as the RSI are showing overbought conditions, suggesting potential price corrections.

Conclusion and Recommendation

Given the bearish trend and overbought conditions, it is recommended to sell Lululemon Athletica (LULU) stocks.

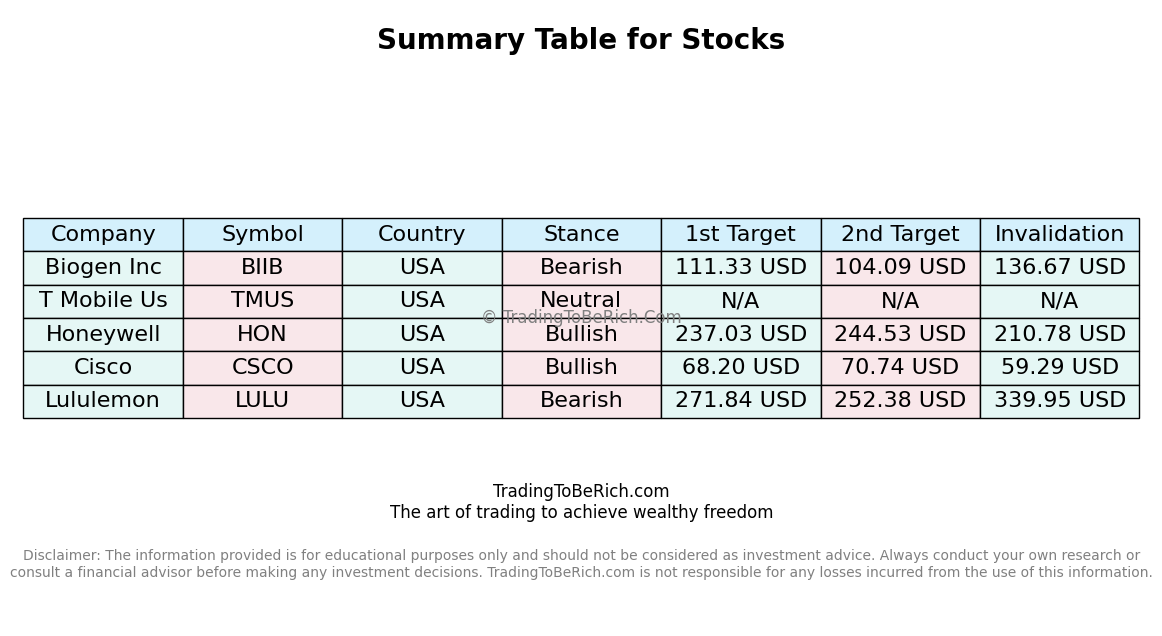

Recommendations and target prices

Conclusion

This analysis provides a comprehensive overview of the fundamental and technical aspects of Biogen Inc (BIIB), T-Mobile US (TMUS), Honeywell (HON), Cisco Systems (CSCO), and Lululemon Athletica (LULU). Based on the data and trends, it is recommended to sell BIIB and LULU stocks, hold TMUS stocks, and buy HON and CSCO stocks.

FAQ

- What is the best time to buy BIIB stocks? It is advisable to avoid buying BIIB stocks during overbought conditions and wait for a potential price correction.

- Why is TMUS a good investment? TMUS is a good investment due to its strong revenue growth, profitability, and bullish technical indicators.

- What are the key financial ratios to consider for HON? Key financial ratios to consider for HON include the P/E ratio, P/B ratio, and beta value.

- How does CSCO compare to other tech stocks? CSCO has shown strong revenue growth and profitability, making it a competitive option among tech stocks.

- What are the risks associated with LULU stocks? Risks associated with LULU stocks include bearish trends and overbought conditions, which may lead to price corrections.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.