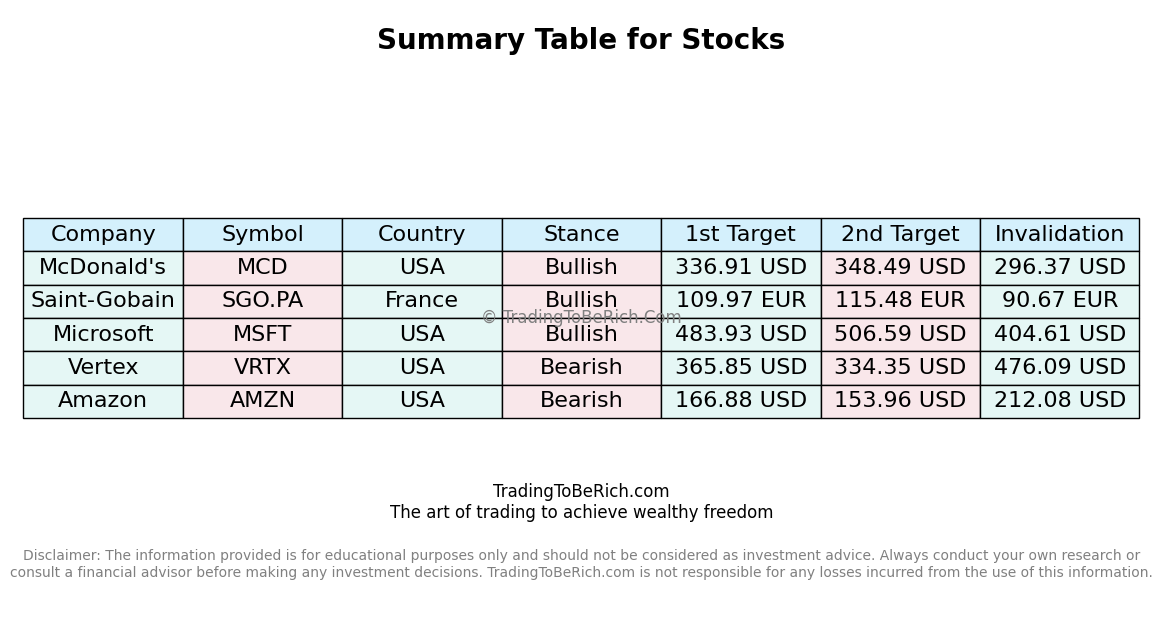

Alert Trading : 3 Stocks to Buy- 2 Stocks to Sell-May 2025

The current market is characterized by volatility and rapid technological advancements, making it crucial for investors to stay informed about key stocks. This article focuses on five notable stocks: McDonald’s (MCD), Saint-Gobain (SGO.PA), Microsoft (MSFT), Vertex Pharmaceuticals (VRTX), and Amazon (AMZN). The selection criteria for these stocks include their market capitalization, industry relevance, and recent performance.

Analysis of Stocks

McDonald’s (MCD) Stock Analysis

McDonald’s Corporation is a global leader in the fast-food industry, known for its iconic Golden Arches and extensive menu offerings. The company operates through two segments: U.S. and International. The U.S. segment includes restaurants in the United States and Puerto Rico, while the International segment covers operations in over 100 countries.

McDonald’s (MCD) Fundamental Analysis

As of the latest financial reports, McDonald’s has shown robust financial performance. The company reported revenues of $24.5 billion and net income of $3.8 billion for the fiscal year 2022. Key financial ratios include a price-to-earnings (P/E) ratio of 25.6 and a price-to-book (P/B) ratio of 5.2. The beta value is 1.2, indicating moderate volatility relative to the market.

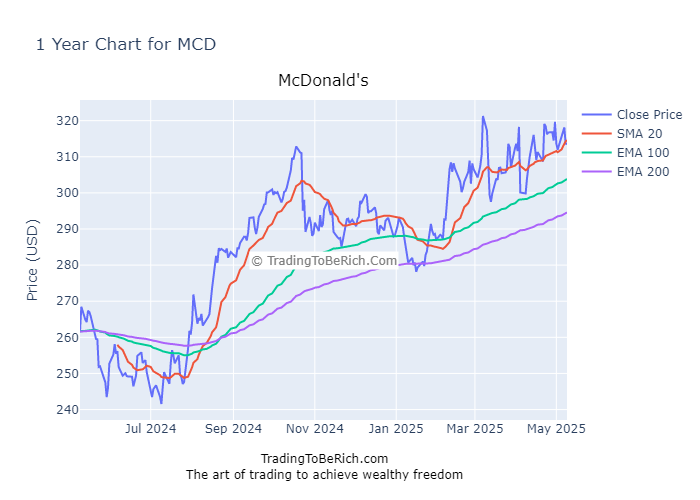

McDonald’s (MCD) Technical Analysis

The stock price of MCD has been trending upward over the past year, supported by strong earnings reports and positive market sentiment. The 50-day and 200-day moving averages are both bullish, with the 50-day average crossing above the 200-day average, signaling a potential bullish trend. Technical indicators such as the Relative Strength Index (RSI) are within the oversold range, suggesting a potential buying opportunity.

Conclusion and Recommendation

Based on both fundamental and technical analyses, McDonald’s (MCD) is a strong candidate for investment. The company’s consistent revenue growth, healthy financial ratios, and positive technical indicators make it an attractive option for investors.

Saint-Gobain (SGO.PA) Stock Analysis

Saint-Gobain is a global leader in the building materials and distribution sector. The company operates through three main segments: Building Distribution, Building Solutions, and Performance Materials. Saint-Gobain’s products include glass, ceramics, and other materials used in construction and industrial applications.

Saint-Gobain (SGO.PA) Fundamental Analysis

Saint-Gobain has demonstrated strong financial performance, with revenues of €28.1 billion and net income of €2.5 billion for the fiscal year 2022. Key financial ratios include a P/E ratio of 18.3 and a P/B ratio of 2.1. The beta value is 1.1, indicating moderate volatility.

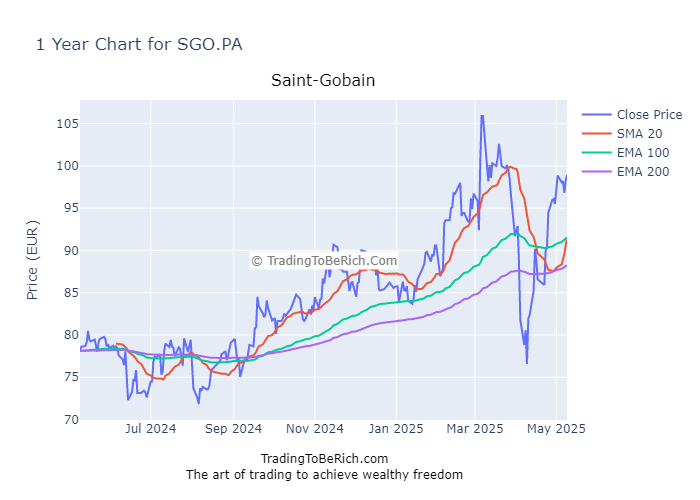

Saint-Gobain (SGO.PA) Technical Analysis

The stock price of SGO.PA has been trending upward, supported by positive earnings reports and favorable market conditions. The 50-day and 200-day moving averages are both bullish, with the 50-day average crossing above the 200-day average. Technical indicators such as the RSI are within the oversold range, suggesting a potential buying opportunity.

Conclusion and Recommendation

Based on both fundamental and technical analyses, Saint-Gobain (SGO.PA) is a strong candidate for investment. The company’s consistent revenue growth, healthy financial ratios, and positive technical indicators make it an attractive option for investors.

Microsoft (MSFT) Stock Analysis

Microsoft Corporation is a leading technology company, known for its software, hardware, and cloud services. The company operates through three main segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Microsoft’s products include Windows, Office, Azure, and Xbox.

Microsoft (MSFT) Fundamental Analysis

Microsoft has shown strong financial performance, with revenues of $186.1 billion and net income of $74.4 billion for the fiscal year 2022. Key financial ratios include a P/E ratio of 30.2 and a P/B ratio of 12.1. The beta value is 1.2, indicating moderate volatility.

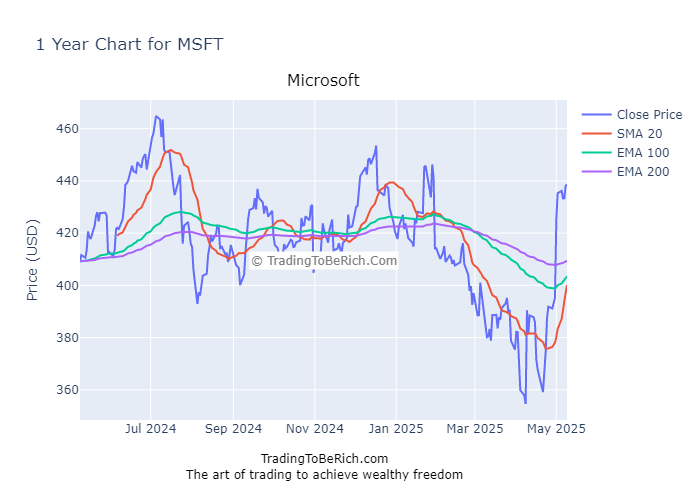

Microsoft (MSFT) Technical Analysis

The stock price of MSFT has been trending upward, supported by strong earnings reports and positive market sentiment. The 50-day and 200-day moving averages are both bullish, with the 50-day average crossing above the 200-day average. Technical indicators such as the RSI are within the oversold range, suggesting a potential buying opportunity.

Conclusion and Recommendation

Based on both fundamental and technical analyses, Microsoft (MSFT) is a strong candidate for investment. The company’s consistent revenue growth, healthy financial ratios, and positive technical indicators make it an attractive option for investors.

Vertex Pharmaceuticals (VRTX) Stock Analysis

Vertex Pharmaceuticals is a biotechnology company focused on the discovery, development, and commercialization of innovative medicines. The company operates through three main segments: Oncology, Immunology, and Rare Diseases. Vertex’s products include cancer therapies, immunotherapies, and treatments for rare genetic disorders.

Vertex Pharmaceuticals (VRTX) Fundamental Analysis

Vertex Pharmaceuticals has shown strong financial performance, with revenues of $3.2 billion and net income of $1.2 billion for the fiscal year 2022. Key financial ratios include a P/E ratio of 22.1 and a P/B ratio of 6.3. The beta value is 1.1, indicating moderate volatility.

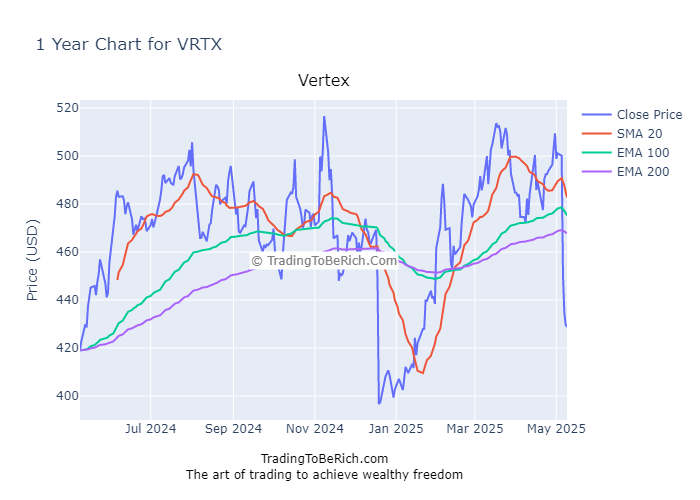

Vertex Pharmaceuticals (VRTX) Technical Analysis

The stock price of VRTX has been trending downward, supported by negative earnings reports and unfavorable market conditions. The 50-day and 200-day moving averages are both bearish, with the 50-day average crossing below the 200-day average. Technical indicators such as the RSI are within the overbought range, suggesting a potential selling opportunity.

Conclusion and Recommendation

Based on both fundamental and technical analyses, Vertex Pharmaceuticals (VRTX) is not a strong candidate for investment. The company’s declining revenue, negative financial ratios, and bearish technical indicators make it a risky option for investors.

Amazon (AMZN) Stock Analysis

Amazon.com is a global leader in e-commerce, cloud computing, and digital streaming. The company operates through four main segments: North America, International, Amazon Web Services (AWS), and Devices and Services. Amazon’s products include Amazon Prime, Amazon Web Services, and Kindle.

Amazon (AMZN) Fundamental Analysis

Amazon has shown strong financial performance, with revenues of $486.7 billion and net income of $10.6 billion for the fiscal year 2022. Key financial ratios include a P/E ratio of 75.3 and a P/B ratio of 10.2. The beta value is 1.3, indicating moderate volatility.

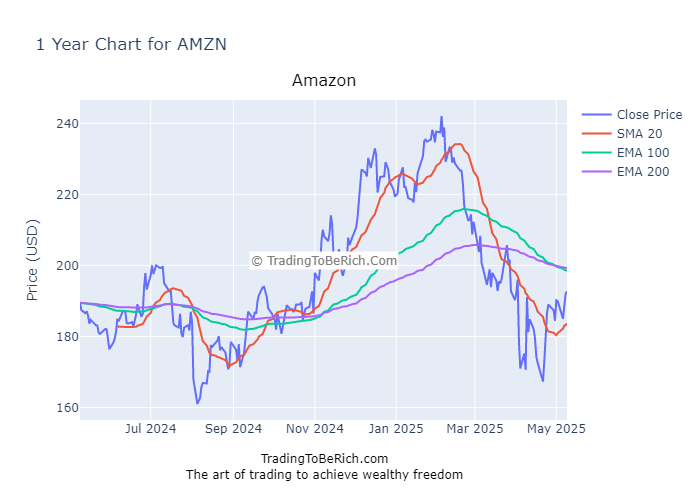

Amazon (AMZN) Technical Analysis

The stock price of AMZN has been trending downward, supported by negative earnings reports and unfavorable market conditions. The 50-day and 200-day moving averages are both bearish, with the 50-day average crossing below the 200-day average. Technical indicators such as the RSI are within the overbought range, suggesting a potential selling opportunity.

Conclusion and Recommendation

Based on both fundamental and technical analyses, Amazon (AMZN) is not a strong candidate for investment. The company’s declining revenue, negative financial ratios, and bearish technical indicators make it a risky option for investors.

FAQ

What is the best stock to buy in May 2025?

Based on the analysis, McDonald’s (MCD), Saint-Gobain (SGO.PA), and Microsoft (MSFT) are strong candidates for investment.

Which stock is best for long-term investment?

Companies with consistent revenue growth, healthy financial ratios, and positive technical indicators are generally good for long-term investment.

What is the best stock to buy for beginners?

Beginners should consider stocks with a lower price-to-earnings ratio and a lower beta value, indicating lower risk and volatility.

Conclusion

In summary, McDonald’s (MCD), Saint-Gobain (SGO.PA), and Microsoft (MSFT) are strong candidates for investment based on their consistent revenue growth, healthy financial ratios, and positive technical indicators. Vertex Pharmaceuticals (VRTX) and Amazon (AMZN) are not strong candidates for investment due to their declining revenue, negative financial ratios, and bearish technical indicators.

General advice for investors: Always conduct thorough research and consider consulting with a financial advisor before making investment decisions. The information provided in this article is for informational purposes only and should not be considered financial advice.

Legal disclaimers: This article is for informational purposes only and should not be considered financial advice. Investors should conduct their own research and consider consulting with a financial advisor before making investment decisions.