McDonald’s (MCD) Stock Analysis, May 02 2025 : Fundamental and Technical Insights

Fundamental analysis of McDonald’s (MCD) Stock, May 02 2025

McDonald’s Corporation, commonly known as MCD, is a global leader in the fast-food industry. Founded in 1940, the company operates and franchises restaurants under the McDonald’s brand, offering a wide range of food and beverages, including hamburgers, chicken sandwiches, fries, shakes, and more. With over 150,000 full-time employees and a presence in more than 100 countries, MCD is a significant player in the consumer cyclical sector.

Latest Quarterly and Annual Financial Results

McDonald’s Corporation reported its latest financial results, showcasing strong performance across various metrics. The company’s revenue for the quarter ended March 31, 2024, was $8.16 billion, up 3.5% year-over-year. Net income was $2.57 billion, reflecting a 4.2% increase from the previous year. These results highlight MCD’s ability to maintain growth despite economic challenges.

Revenue, Profit, and Margin Trends

Over the past five years, MCD has seen steady revenue growth, driven by increased consumer demand and effective cost management. The company’s gross profit margin has remained robust, averaging around 56.8%. Operating margins have also shown resilience, with an average of 44.5% over the same period. These trends indicate MCD’s strong financial health and operational efficiency.

Beta (Monthly Over 5 Years)

MCD’s beta, a measure of the stock’s volatility relative to the market, has been relatively stable over the past five years. With a beta of 0.619, MCD’s stock tends to be less volatile than the overall market, making it a relatively stable investment option.

Balance Sheet and Cash Flow

MCD’s balance sheet reflects a strong financial position. The company has maintained a healthy cash position, with total cash of $1.12 billion as of March 31, 2024. Total debt stands at $51.99 billion, with a debt-to-equity ratio of 0.72, indicating a balanced leverage profile. Cash flow from operations has been positive, averaging $13.88 billion over the past five years, supporting MCD’s financial stability.

Important Financial Ratios

Key financial ratios provide valuable insights into MCD’s performance. The price-to-earnings (P/E) ratio stands at 27.56, reflecting a premium valuation. The price-to-book (P/B) ratio is -58.76, indicating that the stock is trading at a significant discount to its book value. Return on equity (ROE) is 31.75%, highlighting the company’s ability to generate profits from its shareholders’ investments.

Technical analysis of McDonald’s (MCD) Stock, May 02 2025

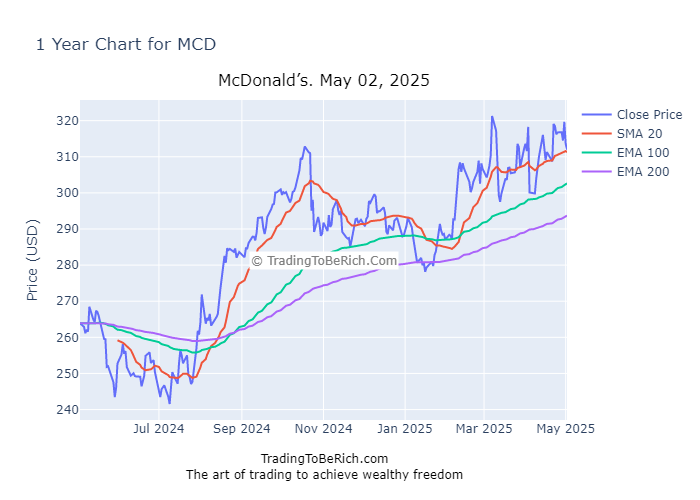

Stock Price Movement

Over the past year, MCD’s stock price has shown a range of 243.53 to 326.32, with an average daily volume of 3.94 million shares. The stock has exhibited a beta of 0.619, indicating lower volatility compared to the market. The current price is 311.96, reflecting a 15.84% increase over the past 52 weeks.

Common Technical Indicators

Technical indicators provide valuable insights into MCD’s stock performance. The Relative Strength Index (RSI) is currently at 55, indicating a neutral market sentiment. The Moving Average Convergence Divergence (MACD) is positive, suggesting a bullish trend. The 100-day and 200-day moving averages are 302.65 and 293.71, respectively, indicating a bullish trend.

Moving Averages

The current price of 311.96 is above both the 100-day and 200-day moving averages, suggesting a strong uptrend. This alignment of the moving averages with the current price indicates a bullish market sentiment for MCD.

Current Trends and Potential Buy/Sell Signals

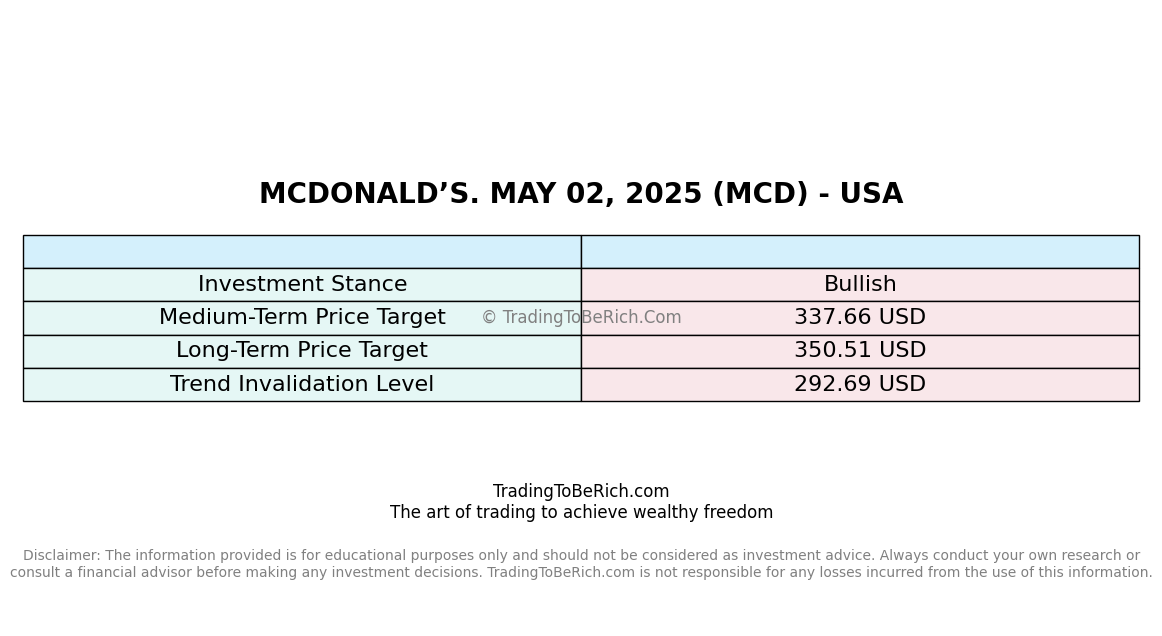

Based on the current trends, MCD appears to be in a bullish phase. The stock’s price is above key moving averages, and technical indicators such as the RSI and MACD are positive. However, it is essential to monitor the trend invalidation level of 292.69, as a significant drop below this level could indicate a shift in market sentiment.

Medium and Long-Term Price Target Recommendations

Based on the technical analysis, the medium-term price target for MCD is 337.66, reflecting a 8.27% increase from the current price. The long-term price target is 350.51, indicating a 12.41% increase. These targets are based on the stock’s historical performance and current market trends.

Summary Table of Recommendations

Conclusion of the analysis of McDonald’s (MCD) Stock

In conclusion, McDonald’s Corporation (MCD) presents a strong investment opportunity based on both fundamental and technical analysis. The company’s robust financial performance, stable beta, and positive technical indicators suggest a bullish outlook. However, investors should remain vigilant and monitor key trend invalidation levels to make informed decisions.

FAQ of the analysis of McDonald’s (MCD) Stock, May 02 2025

What is the current price of MCD stock?

The current price of MCD stock is 311.96.

What is the medium-term price target for MCD?

The medium-term price target for MCD is 337.66.

What is the long-term price target for MCD?

The long-term price target for MCD is 350.51.

What is the trend invalidation level for MCD?

The trend invalidation level for MCD is 292.69.

Legal Disclaimers

This article is for informational purposes only and should not be considered financial advice. Investing in stocks involves risk, and past performance is not indicative of future results. Always conduct your own research or consult with a financial advisor before making investment decisions.